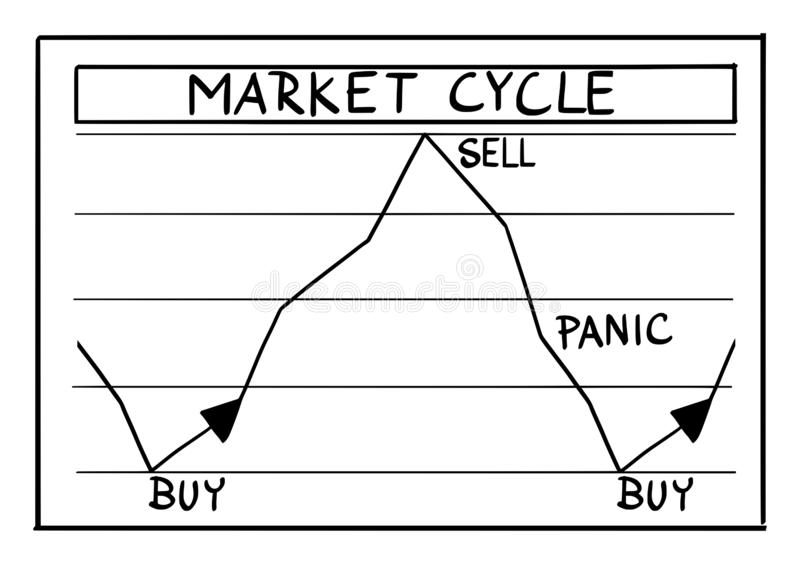

Currently fear, uncertainty and volatility are everywhere in the markets and in times like these it is important to gain a little perspective to help quiet some of the market noise out there so that you don’t make any irrational emotional decisions.

If you are investing for the long term then the biggest mistake you can make as an investor is to sell in panic. Panic selling is an emotional decision and locks in a loss in your portfolio. On the other hand one mistake is that you will more than likely stay out of the market and miss out when the market rebounds, losing out on potential future gains as well.

If you are one of those investors who has excess cash and has a higher risk appetite don’t be too aggressive early on in a bear market.

My personal view is to take a more cautious and considered approach. Investing smaller amounts in this environment reduces the risk of large capital losses but also allows you to take advantage of prices as they go lower.

The best approach I found is to have and maintain a long term strategy and having the right mix of being diversified between growth stocks and keeping some cash aside for emergencies and short term requirements.

You will need a degree of patience to ride out the volatility and bearish market conditions in the short term.

As Warren Buffett says “The stock market is a device for transferring money from the impatient to the patient”

Despite the fear in the markets of late, I maintain my core 3 step strategy to navigate these uncertain markets.

1. Maintain a long term value oriented strategy

Knowing why you are investing in a certain share and what personal goals you are trying to accomplish is very important. If you don’t need your investments to sustain your lifestyle for at least the next 10 years and you are prepared to ride the market when it goes up and down during the period, then you can afford to be aggressive.

If your timeframe is shorter though then I would recommend a more conservative approach.

2. Risk Management & Discipline

Risk management and discipline are critically important to long term success and should not be ignored.

For a long term investor, you should not be too concerned about the short term gains and losses.

The best chance of being successful in the markets I believe is to invest for a period of 10 years or longer. During the 10 years the markets will go through declines. When the markets decline and you have cash on hand, then this may be a great time to look at possible investment opportunities.

When the market goes through periods of decline, I use my Rand cost average approach.

By Rand cost averaging while the market is declining, I am able to invest small amounts on a consistent basis into quality shares that I may already own to reduce my average cost price.

When the market rebounds my gains grow as my cost per share is reduced to my initial cost price per share due cost averaging over the period.

3. Diversification

We have been taught to never put all your eggs in one basket and that the primary goal of diversification is to spread your investment risk so that the performance of one investment doesn’t necessarily affect the performance of your entire portfolio.

I would say to have some diversification in your investments but not too excessive. Ensure that you are diversified into different asset classes or sectors like ETFs and Index Funds so that if one asset class moves down, the other asset class counteracts it.

You will notice that my portfolio is well diversified across many sectors domestically and internationally and in companies that are of different sizes (Large cap, Medium cap, Small cap)

View the portfolio here: https://thecontrarianinvestor.co.za/portfolio/ At the end of the day each investor’s goal and risk profile is different. You need to ensure that you remain disciplined, maintain your goals and have the ability to tolerate various levels of market risk.

Each investors risk will evolve over time, no one knows how the markets will play out which is scary to many so maintain your strategy as best you can and make sure you have good reasons to make a change in your strategy if necessary. Remember that emotional reasons are not good reasons to make changes in your strategy in times of extreme volatility. With the principles of long term investing though you should be able to achieve your financial goals.