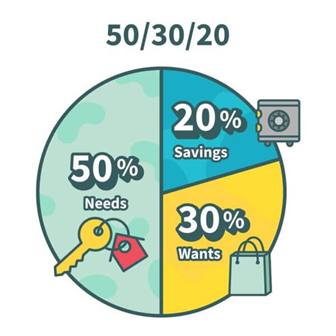

What is the 50/30/20 Budget Strategy?

The 50/30/20 budget strategy is a simple rule of thumb that helps individuals divide their after-tax income into three categories: needs, wants, and savings. The strategy suggests that you use 50% of your income to be allocated towards essential needs, such as housing, transportation, food, and healthcare. 30% of your income should be allocated towards discretionary spending, such as entertainment, dining out, and hobbies. The remaining 20% of your income should be allocated towards savings and debt repayment.

The Advantages of the 50/30/20 Budget Strategy

The 50/30/20 budget strategy has several advantages that make it a popular approach to personal finance management. Here are a few benefits of this strategy:

-

- Simplicity: The 50/30/20 budget strategy is easy to understand and implement, making it accessible to anyone, regardless of their financial knowledge or experience.

- Flexibility: This strategy is flexible and allows individuals to adjust their spending and savings priorities based on their unique circumstances and goals.

- Prioritization: The 50/30/20 budget strategy helps individuals prioritize their spending and savings goals, ensuring that essential needs are met, discretionary spending is enjoyable, and savings are consistently growing.

- Debt Reduction: Allocating 20% of your income towards debt repayment can help reduce the burden of high-interest debt and accelerate your path towards financial freedom.

How to Implement the 50/30/20 Budget Strategy

Implementing the 50/30/20 budget strategy is simple and straightforward. Here are the basic steps to get started:

-

- Calculate your after-tax income: This is the amount of money you have available to allocate towards your expenses and savings.

- Allocate 50% of your income towards essential needs: This includes expenses such as housing, transportation, food, and healthcare. It’s important to be realistic and conservative when estimating your needs to ensure that your budget is sustainable over time.

- Allocate 30% of your income towards discretionary spending: This includes expenses such as entertainment, dining out, and hobbies. You have to enjoy life and have fun too while staying within your budget.

- Allocate 20% of your income towards savings and debt repayment: This includes savings for emergencies, retirement, and other financial goals. It also includes debt repayment, such as credit card balances or personal loans.

- Monitor and adjust your budget regularly: Review your budget regularly to ensure that you are staying within your allocated categories and making progress towards your financial goals. Adjust your budget as needed to account for changes in income or expenses.

Happy budgeting