If you are buying a share in a company and you anticipate holding it for a number of years, what you buy and the price you pay will determine how much money you make.

From a value investing perspective you want to buy companies that are profitable and have a durable competitive advantage.

I analyse these three important financial statements of a business:

1. Income Statement

2. Balance Sheet

3. Cash Flow Statement

By digging deeper into these statements I am able to determine more or less the true worth of the business i.e. Its Intrinsic value.

As a long term value investor I try to predict its future earnings to determine whether the company has the strength to survive over the next few decades.

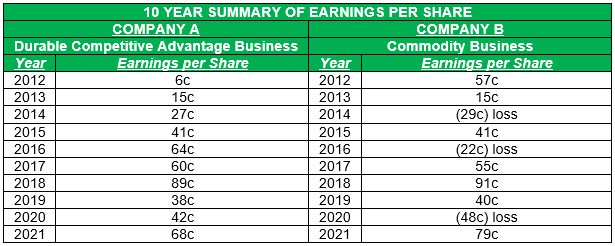

A company with a lack of strong earnings history makes it fairly difficult to predict so I review the earnings history of the company and I gather the earnings per share of the last 10 years to see whether they are stable or unstable. There will be occasions whereby the earnings per share may have suffered a weak performance compared to the years before eg. During the Covid pandemic.

What I look for is for the company to have strong consistent and growing earnings per share.

Looking at a 10 year summary of a company’s earnings per share will tell you a great deal about a company.

As you can see above, Company A with a durable competitive advantage has more predictable earnings than Company B.

As an investor, what would you be willing to predict future earnings?

Company A has strong stable upward trending earnings while Company B has a lack of strong earnings so its future earnings potential would be unstable and harder to predict.

I want a company that shows a strong upward trend in earnings per share over the last 10 years.

A company with a history of strong earnings per share that have suffered temporary setbacks in recent years are interesting. Companies that endured and performed well during Covid or any sort of pandemic or global catastrophic event especially is an indication of a quality business and one that I like.

Management’s ability to grow its earnings per share is the key to the growth of your investment and share price. To grow the earnings per share you want management to retain some earnings that will generate more earnings per share.

Increasing earnings per share will over time increase the market value of a company and that is what any investor would desire.