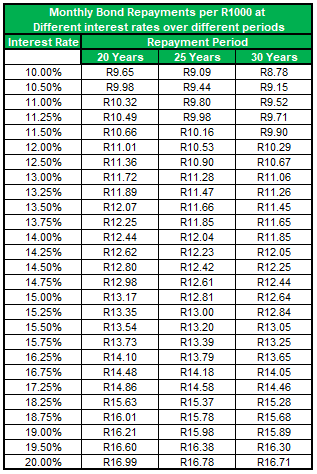

Monthly Bond repayments per R1000 at different interest rates over different periods

It is crucial for all homeowners to understand the key differences between a 20 year, 25 year and 30 year home loan. There are pros and cons to each term and deciding on the right one could save you thousands of Rands in the long run.

The most important aspect to consider is your current financial situation and how your new bond will affect this. Make sure that you do not over commit yourself and always make provision for possible interest hikes.

The South African Reserve Bank (SARB) has hiked rates by 200 basis points (2%) since its hiking cycle started in November 2021, putting indebted consumers under further financial strain for thousands of Rands more.

For every R1 million of debt that a household has, it will now cost R20 000 more each year or R1 667 per month.

The latest interest rate hike will lead to a higher cost of living for us South Africans, who are already over indebted.

With the US FED raising their interest rates yesterday by 75bps (0.75%) to curb their high inflation rate, its most likely seems that the SARB will increase interest rates by at least another 0.50% – 0.75% this year and should increase interest rates by a possible further 1.50% in 2023. This indeed paints a bleak picture for us in the upcoming few years ahead.

In the table above, you will find that a 20 year home loan comes with a larger instalment than a 30 year home loan.

To give you an indication of the financial implications of your home loan I have used a R1 000 000.00 bond with an interest rate of 10.25% as an example. The monthly repayment over 20 years will be R9 650.00 whereas the repayment over a 30 year period would be R8 780.00. The monthly payment difference would therefore be R870.00.

While a lower repayment may seem attractive at the time, it is important to calculate the difference in the total amounts paid back.

Using the same example the total repayment over a 20 year period will be R2 316 052.00 and R3 159 258.00 over a 30 year period. The difference is a whopping R843 206.00!

These calculations have not even taken into account possible interest rate increases or inflation.

Should you be in a position to afford a 20 year payment plan, I would personally make a short term sacrifice and pay a bit more in repayments for a long term goal of owning a home.

If you want a purchase a home and do not earn a huge monthly salary, you have two options.

The first is to take the slow approach and purchase one property at a time as your means allow. This involves purchasing a property to live in and paying off as much of the bond as quickly as possible. Once you have paid off a considerable amount of the bond, you can apply for finance to purchase another property on the basis that you can service the existing bond, as well as the bond on your new property.

The second option is to fast track the process and purchase more than one property at a time.

As a start, two salaries are better than one. If you are married or in a committed relationship, or if you can purchase property together with a good friend or relative, the bank looks at the ability of both partners to service the bond or bonds. For example, if each partner earns R30 000 per month, the bank will see this as a combined gross monthly salary of R60 000. Based on the 30% rule, it will advance the partners a bond that requires monthly bond repayments of R18 000.

If you look at the table above, this means that the partners can purchase a property or properties worth up to R1.8 million if they are granted the loan over a 20 year period at an interest rate of 10.50 per cent.

This is considerably more than the R900 000 each partner would have been granted in their personal capacity.

If you earn a salary of R30 000 per month, the bank will grant you a bond that does not require more than R9 000 per month to service.

This 30 per cent rule is not cast in stone but it does give you a good indication of the level of funding the bank will be prepared to advance to you as an individual.

The table is useful in helping you determine what it costs to repay bonds for different amounts on a monthly basis at different interest rates over various periods of time. In the table, repayments are calculated per R1 000 borrowed.

For example if you seek a bond of R900 000 at an interest rate of 11.50 per cent, it will cost you R10.66 x 900 (900 000/1000) = R9 594 per month over a 20 year repayment period.

At the end of the day, property is a great way and strategy to begin building wealth. It can generate ongoing passive income and can be a good long term investment if the value increases over time. Investing is always a risk so start small, keep your expectations realistic and work within your budget.

Happy Investing