The goal of a company’s management is to maximize its return for shareholders and a share buyback generally increases shareholder value.

A share buyback, also known as a “share repurchase”, is where a company repurchases its own shares in the open market. You can think of a share buyback as a company investing in itself, or using its cash to buy its own shares. Similar to dividends, it is a way for companies to return cash to shareholders.

The idea is fairly simple.

Because a company can’t act as its own shareholder, repurchased shares are absorbed by the company, and the number of outstanding shares on the market is reduced. When this happens, the ownership stake of each investor increases because there are now fewer shares outstanding, or claims on the earnings of the company.

Sometimes the company management may feel that the market has discounted its share price too steeply so buybacks of shares is the best strategy for companies to use when the current share price is less than their calculated fair value.

During market downturns, such as in a recession, or when there are low attractive interest rate yields, companies will borrow money to buy back their shares. They use this opportunity to purchase some of their own shares which reduces the number of shares outstanding. This strategy can help generate earnings per share (EPS) growth even when there is no earnings growth at all.

When there are less shares outstanding, the future earnings per share is likely to increase. The company share price can fall in the market for many reasons like weaker than expected company earnings results, an Accounting scandal or just a poor overall economic climate.

Thus, when a company spends millions of Rands buying up its own shares, it says management believes that the market has gone too far in discounting the shares which is a positive sign.

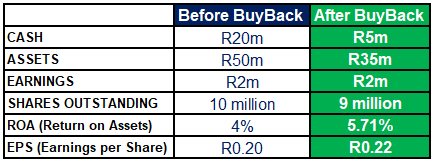

Suppose a company repurchases one million shares at R15 per share for a total cash outlay of R15 million. Below see the change as a result of the buyback.

As you can see, the company’s cash has been reduced from R20 million to R5 million.

Because cash is an Asset, this will lower the total assets of the company from R50 million to R35 million. This then leads to an increase in its ROA (Return on Assets), even though its earnings have not changed.

Prior to the share buyback, its ROA was 4% (R2 million/R50 million) but after the repurchase, ROA increases to 5.71% (R2 million/R35 million).

The same can be seen in the EPS number, which increases from 20 cents

(R2 million/10 million shares) to 22 cents (R2 million/9 million shares).

The share buyback also helps to improve the company’s price-earnings ratio (P/E).

The P/E ratio is one of the most well-known and often used measures of value. When it comes to the P/E ratio, the market often thinks lower is better.

Therefore, if we assume that the share price remains at R15, the P/E ratio before the buyback is 75 (R15/20 cents) but after the buyback, the P/E decreases to 68 (R15/22 cents) due to the reduction in outstanding shares.

In other words, a fewer amount of shares + same earnings = higher EPS!

Based on the P/E ratio as a measure of value, the company is now less expensive than it was prior to the repurchase despite the fact there was no change in its earnings.

From a shareholder’s point of view, I try to make a judgement as to whether the company’s offer to purchase their own shares is a sensible move by comparing their buying price to my estimate of its fair value which is what I would be prepared to pay for the share from a value investing perspective.

So depending on the price at which the offer is made, share buybacks may be a good thing, or a not so good thing for a value investor.